Fries, wedges, mashed – the humble potato appears on almost every menu. It’s time to take this familiar, 100% usable ingredient to new places on the menu.

Delivering The Brands You Love

The Team Behind

Great Meals

Respect. Responsibility. Reliability. That’s what you deserve. That’s what we deliver.

At Gordon Food Service, we believe that great meals create great memories. We stand behind the teams delivering great meals everyday. That’s why we’re with you at every step. From delivering great products to solving the turbulence of the supply chain, you have a team that helps you continue to succeed, evolve, and grow.

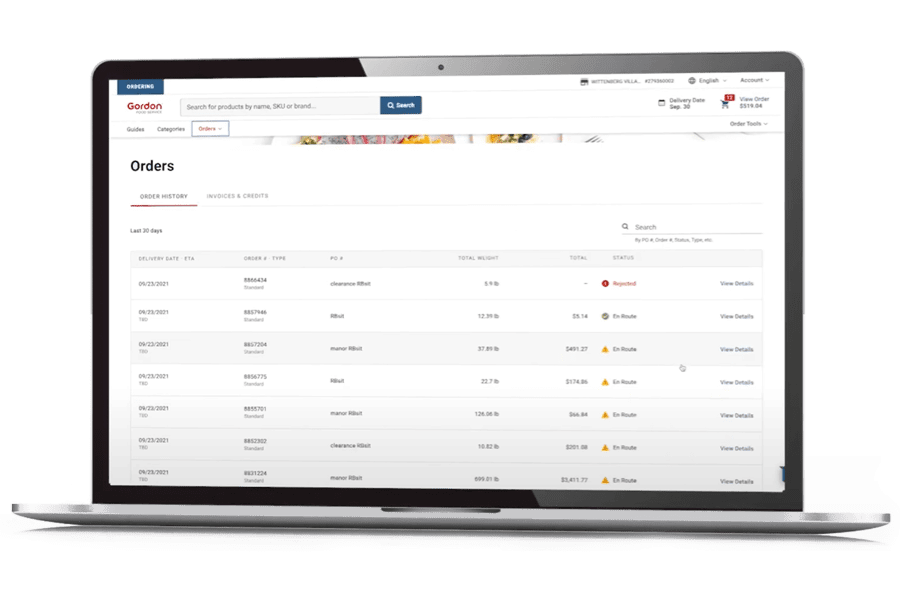

High-Tech & High-Touch Partner From End to End

Tools designed to make managing your business easier, and team members to help you from truck to table.

Your all-in-one restaurant management tool. Track labor cost, food costs, manage inventory and more.

The recipe tool designed by Chefs, for Chefs. Manage your recipes, train efficiently, reduce food waste and more.

With Gordon Now tools, you are able to manage your business whenever, wherever, and however you want.

Grow Your Business

Restaurants

Products and tools to help restaurants deal with tight margins and changing demands.

Education

Broad selection and sustainable choices for changing consumer needs.

Healthcare

Great food and regulatory expertise to cut through red tape and get to the table.

Every Dish Tells a Savory Story

Follow our journey as we continue to grow in the foodservice industry.

Food for Thought

Thought Leadership To Feed Your Business Needs

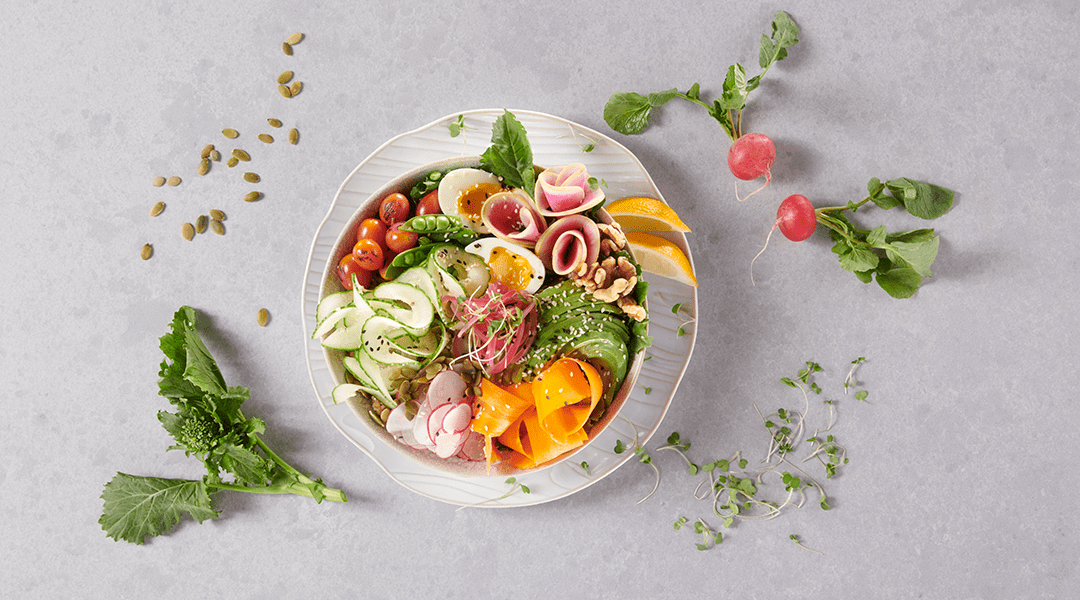

Eating your greens never felt so good. Markon avocados are sourced from MegaMex Foods, with a focus on producing quality food and protecting the environment.

Inspired by the belief that food should not only taste good, it should do good too, Gordon Food Service® highlights the Goodfinds by Gordon program.